Financial Services Sales Training Programmes

Empower your team to excel by developing the capabilities to drive sustainable revenue growth and long-term success.

Our Financial Services Sales Training Clients

The financial services industry is rapidly transforming because of the rise of embedded finance (EF) which creates frictionless customer experiences in payments, insurance, investing, and lending. While EF allows financial institutions to expand through partnerships with nonfinancial companies, it also puts an intermediary between banks and their customers, making relationship-building more difficult.

Sales teams must also face sector-specific challenges. In retail and commercial banking, slowing loan production has heightened the need to boost deposits. In insurance, rising costs make it difficult to raise premiums without losing customers to EF competitors offering seamless experiences. Asset managers must counter outflows by delivering exceptional customer experiences and expanding direct-to-consumer channels. Commercial real estate sellers struggle with the high cost of capital and vacant office spaces, requiring them to automate back-end processes and focus on driving new business.

For sales leaders in financial services, this evolving, competitive landscape creates a critical need to develop new skills in their teams. Financial services sales training is no longer just about product knowledge—it's about strategic selling, cross-selling, negotiation, and the ability to articulate value in a tech-driven marketplace.

To help our clients overcome these challenges Richardson’s financial services sales training enables agents to more effectively:

- Cross-sell financial products and lead customer conversations, deepening relationships and driving revenue growth.

- Position price increases while maintaining strong relationships, crucial for competing against embedded finance solutions.

- Diagnose client needs and deliver tailored, value-driven solutions that go beyond basic tech offerings.

- Control negotiations through trust and strategic persuasion, ensuring mutually beneficial outcomes and long-term success.

Sales Training Programmes for Financial Services Teams

At Richardson, we’ve identified 16 key selling capabilities that all sales professionals must master to enhance their commercial selling competitiveness. To support the development of these capabilities, we offer content and strategies to teach sellers these skills and behaviours.

Our financial services sales training programmes sharpen skills across several capabilities including:

- Pipeline Management: Organising, optimising and managing the flow of opportunities through the stages of the sales process

- Forecasting Accurately: Creating accurate sales forecasts as required by the business

- Positioning a Price Increase: Leading a meeting to introduce a new pricing structure to a customer

- Executing Multi-touch Prospecting Plans: Developing an executing a prospecting plan across engagement channels

- Selling with Value: Incorporating value into every step of the customer’s journey.

- Controlling Negotiations: Effectively responding to customer demands to preserve terms and avoid trading

Richardson is proud to offer several pathways to developing these capabilities. You can work with us to customize a blended-learning solution based on the following programmes:

Sprint Selling Training

As loan production slows, and liquidity management becomes more critical, financial services sales professionals must become experts at managing opportunities in their pipelines. The Sprint Selling training programme provides sellers with training on agile selling skills, a framework for evaluating opportunities, and access to sales technology that helps them forecast and manage their opportunities more accurately, enabling them to balance deposit and loan ratios effectively.

Positioning a Price Increase Training

Financial services sales professionals need a clear plan for approaching customers with price increases. The Positioning a Price Increase training programme content breaks down this process into three stages—prepare, notify, and respond—while equipping sellers with trading strategies that preserve customer relationships. We teach sellers how to identify the value of trades and space negotiations incrementally, ensuring that they maintain control of the conversation.

Sprint Prospecting Training

Today’s financial services clients, particularly high-net-worth Millennials, expect a blend of in-person and virtual engagement. The Sprint Prospecting training programme teaches sellers how to develop multi-touch cadences that combine traditional methods with social media and digital channels to capture attention and build lasting relationships.

Sprint Negotiations Training

Negotiating with financial services and products buyers is about more than exchanging terms; it’s about creating trust and value. Sprint Negotiations training focuses on building skills to enable sellers to reinforce trusted relationships and ensuring they control negotiations by treating them as an ongoing process of value persuasion. With these skills financial services sales professionals are able to better manage tough conversations and turn them into opportunities for future business.

The Accelerate Sales Performance System

For those looking to leverage technology, our innovative Accelerate Sales Performance System offers a data-driven approach to training. By analyzing real-time performance data, leaders can understand what successful selling looks like within their organization. This system creates personalized learning journeys, ensuring every team member develops the skills needed to excel in financial services sales.

The Advantage of Richardson’s Financial Services Sales Training Programmes

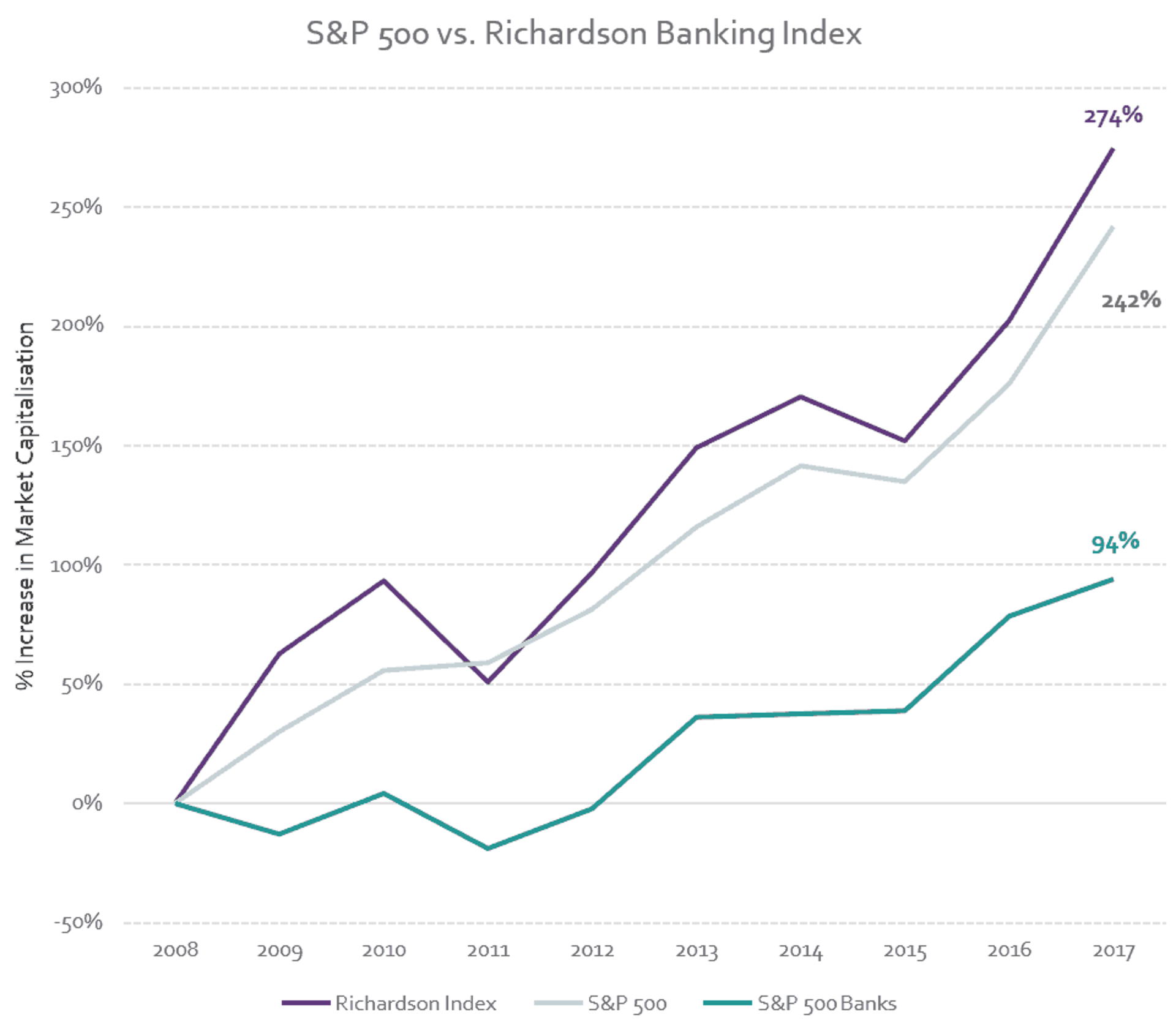

Richardson’s sales training has enabled hundreds of global financial institutions to consistently exceed their revenue goals. Our clients outperform the S&P 500 in percentage increase in market capitalization year after year, proving the effectiveness of our approach.

Our training is tailored to each organization, delivering customized solutions that highlight the unique value of your offerings while considering industry regulations and the complexities of selling financial products.

This customized approach is key to helping sales teams deliver a differentiated customer experience.

Financial Services Sales Training Success Story

A great example of this is our work with Oppenheimer Funds. Faced with increasing commoditization, Oppenheimer partnered with Richardson to enhance its customer interactions. We trained their sales professionals to ask better questions and communicate deeper value beyond just product features, elevating the customer experience.

The impact was sustained through leadership coaching, which empowered managers to foster a culture of commitment to the new sales approach. The results speak for themselves:

- 60% increase in strategic dialogue skills

- 23% improvement in follow-up and closing abilities

- 17% gain in building trust and access among prospects

By equipping Oppenheimer’s team with agile consultative selling skills and coaching capabilities for leaders, Richardson helped transform their customer interactions, driving long-term success and measurable performance gains.

Brief: Rebuilding Skills for a Changed Banking and Finance Industry

Download this brief to learn how sellers can adapt to new challenges in the banking and finance industry.

Download

Our Impact

900Global Clients

3.5M+Individuals Trained

12%5-12% Increase in Revenue

24%Improvement in skill efficiency

35%Increase in knowledge proficiency